The Company currently does not plan to conduct any work to verify the historical estimates other than using them to guide its exploratory and possible development work.

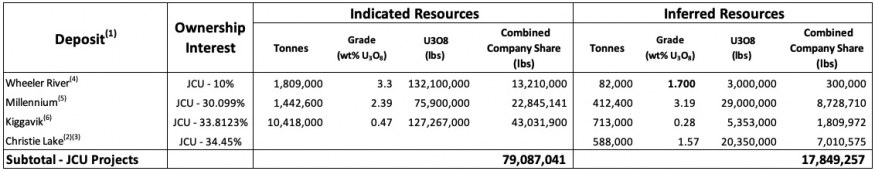

The resulting portfolio will have a significant resource base, and ownership interests in two Tier 1 Athabasca uranium development projects, Wheeler River and Millennium, both of which have production visibility within the next uranium upswing.

UEX’s cash payments will consist of C$10 million on closing and up to C$2.5 million which is expected to be paid within 45 days of the closing date, subject to adjustment based upon JCU’s actual working capital on the closing date.

OURD is a private Japanese company with 29 shareholders comprised of some of the major companies in Japan.

Other than the usual trade payables and current obligations under its joint ventures, JCU has an outstanding liability to the Japan Atomic Energy Agency as a result of a transaction in November 2000 pursuant to which JCU acquired the Canadian exploration assets of PNC Canada.

The purchase price paid to PNC Canada was not funded in cash, but rather through an agreement to make payments from free cash flow derived from future production of uranium from the acquired projects.

The requirement for future cash flow payments to JAEA ceases on the earlier of payment of all outstanding liability and the termination date of March 31, 2030 at which time all financial obligations to JAEA are deemed to have been paid and are fully extinguished.

UEX is a Canadian uranium and cobalt exploration and development company involved in an exceptional portfolio of uranium projects, including a number that are 100% owned and operated by UEX, one joint venture with Orano Canada Inc.

The Company is also leading the discovery of cobalt in Canada, with three cobalt-nickel exploration projects located in the Athabasca Basin of northern Saskatchewan, including the only primary cobalt deposit in Canada.

Our portfolio of projects is located in the eastern, western and northern perimeters of the Athabasca Basin, the world’s richest uranium belt, which in 2019 accounted for approximately 12.6% of the global primary uranium production.

JCU has partnerships with UEX, Orano, Cameco, Denison and others on uranium exploration and development projects in the Athabasca Basin of Northern Saskatchewan including Millennium and Wheeler River and the Kiggavik project in the Thelon Basin in Nunavut.

Important factors that could cause actual results to differ materially from UEX’s expectations include uncertainties relating to the historic resource estimates on the JCU properties, continuity and grade of deposits, fluctuations in uranium, cobalt and nickel prices and currency exchange rates, changes in environmental and other laws affecting uranium, cobalt and nickel exploration and mining, and other risks and uncertainties disclosed in UEX’s Annual Information Form and other filings with the applicable Canadian securities commissions on SEDAR.

The Company is not treating this information as current mineral resources, has not verified this information and is not relying on it.

with an effective date of December 13, 2018 which was filed on SEDAR at www.sedar.com on February 1, 2019.

The reader is cautioned that UEX is not aware whether Cameco’s reporting of resources conforms to NI 43-101 and CIM guidelines.

Kiggavik resources as reported by Orano in their 2019 Activities Report available on their website at https://www.orano.group/docs/default-source/orano-doc/finance/publications-financieres-et-reglementees/2019/orano_2019_annual_activity_report.pdf?sfvrsn=2abbc744_8 and converted from tonnes U to pounds U3O8 and from %U to %U3O8.

Inferred resources have been modified from the stated values in the Christie Lake Technical Report to reflect UEX’s increase in the ownership of Christie Lake Project from 60% to 65.5492%% effective January 1, 2021.