, representing total consideration of approximately $2.1 billion based on the closing price of the Trulieve Shares on May 7, 2021.

This combination offers us the opportunity to leverage our respective strong foundations and propel us forward with an unparalleled platform for future growth,” stated Kim Rivers, Chief Executive Officer of Trulieve.

The Transaction is subject to, among other things, the approval of the necessary approvals of the Supreme Court of British Columbia, the approval of two-thirds of the votes cast by Harvest Shareholders at the Special Meeting, receipt of the required regulatory approvals, including, but not limited, approval pursuant to the Hart–Scott–Rodino Antitrust Improvements Act, and other customary conditions of closing.

The Harvest Board unanimously recommends that Harvest Shareholders vote in favour of the resolution to approve the Transaction.

acted as exclusive financial advisor and DLA Piper LLP and Fox Rothschild LLP acted as Canadian and United States legal counsel, respectively, to Trulieve.

Moelis & Company LLC acted as financial advisor and Bennett Jones LLP and Troutman Pepper LLP acted as Canadian and United States legal counsel, respectively, to Harvest.

Access to the webcast will be available at Trulieve.com or https://produceredition.webcasts.com/starthere.jsp?ei=1462748&tp_key=b56ece63d6 In addition, an investor presentation providing an overview of the transaction can be accessed on the Investor Relations page of the Trulieve and Harvest investor websites.

Since 2011, Harvest has been committed to expanding its retail and wholesale presence throughout the U.S., acquiring, manufacturing, and selling cannabis products for patients and consumers in addition to providing services to retail dispensaries.

Trulieve cultivates and produces all of its products in-house and distributes those products to Trulieve-branded dispensaries throughout the State of Florida, as well as directly to patients via home delivery.

Forward-looking information and statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors which may cause actual events, results, performance, or achievements to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking information and statements herein, including, without limitation, the risks discussed under the heading “Risk Factors” in the Company and Harvest’s Annual Reports on Form 10-K for the year ended December 31, 2020 filed with the United Sates Securities and Exchange Commission on EDGAR and with certain Canadian regulators on SEDAR at www.sedar.com and in other periodic reports and filings made by the Company and Harvest with the SEC on EDGAR and with such Canadian securities regulators on SEDAR.

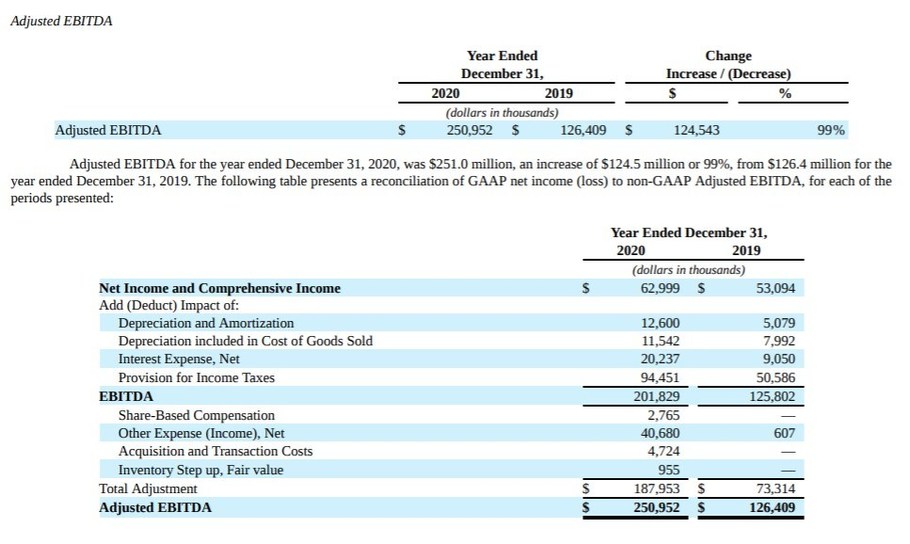

This reflects the Adjusted EBITDA of both Trulieve and Harvest on a combined basis for the fiscal year ended December 31, 2020.

Accordingly, we believe that adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects of the combined company, and allowing for greater transparency with respect to key financial metrics used by our management teams in its financial and operational decision-making.