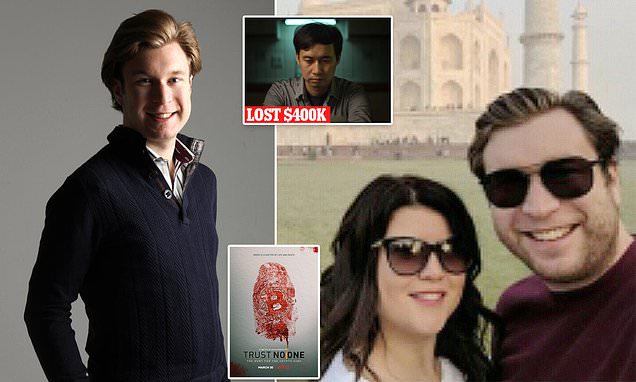

Proving that truth really is stranger than fiction, a new Netflix documentary, ‘Trust No One: The Hunt for the Crypto King’ chronicles a group of investigators and internet sleuths as they attempted to unravel the mystery surrounding the suspicious death of the bitcoin millionaire.

Suddenly sensational theories flooded the internet that the Bitcoin millionaire had faked his own death, run off with the money, and was living under an assumed identity abroad.

Similar to websites like Robinhood or E* Trade for stocks, Quadriga allowed users to trade dollars into bitcoin and vice versa.

Tong Zou knew something was terribly wrong when two months after he requested to withdraw money from his Quadriga accounts, the funds still hadn’t showed up in his checking account.

‘I started to panic, this is my entire savings built through tens years of work and selling my apartment.

According to an affidavit given by his late wife Jennifer Robertson, Quadriga could not pay-out its investors because she did not have the recovery keys for the company’s ‘cold’ wallets — a system in which cryptocurrencies are stored offline to avoid hacking.

Quadriga clients were stunned to discover that the 30-year-old CEO was the the only person with access to the passwords of digital wallets that contained $215 million in cash and cryptocurrency belonging to them.

Cotten’s late wife, Jennifer Robertson became the focus of the investigation when it was discovered that Cotten, suspiciously drafted a will that left all his assets to her, just three days before embarking on the trip.

On November 30, three days after signing his will, Cotten and Robertson landed in New Delhi on a tourist visa.

Most cryptocurrency exchanges keep a small percentage of their holdings in ‘hot wallets’ which act more like a checkbook or debit card to facilitate fast trades.

According to Canada’s Globe and Mail, the newlyweds were nine days into their honeymoon when the couple arrived at the $932-a-night Oberoi Rajvilas hotel in Jaipur on December 8, 2018.

A report by Cotten’s attending physician, Dr Jayant Sharma, revealed that he suffered from Crohn’s disease, a chronic ailment that causes inflammation of the digestive tract.

By 7:26 pm, the 30-year-old crypto-wunderkind was declared dead, officially from ‘complications of Crohn’s disease.’ But the gastroenterologist who treated Cotten told the The Globe and Mail that his death haunted him.

Most cryptocurrency exchanges keep a small percentage of their holdings in ‘hot wallets’ which act more like a debit card to facilitate fast trades.

Among those interviewed for the doc was a man who lost ‘north of six figures’ and who goes by QCXINT .

‘I started to panic, this is my entire savings built through tens years of work and selling my apartment.

From there, security guards working for the luxury 5 star hotel attempted to send his corpse to the Mahatma Gandhi Medical College & Hospital for embalming but the hospital turned down the request.

Cotten’s remains were then taken to a government hospital where the doctors were less inquisitive and an embalming certificate was duly issued.

‘This is not right, something is off,’ said Mousavi to Netflix.

Sparking more suspicion was the fact that just three days before leaving for India, Cotten filed a detailed will that left everything to Robertson: his $12 million real estate portfolio, a Lexus sports car, his Cessna aircraft, a 50-foot sailboat, bank accounts and even frequent flyer points.

The market was in freefall and investors were looking to cash out their cryptocurrency to staunch losses.

He said the conclusion was based on ‘one of the best guesses of what took a 30-year-old man from a luxury hotel to his deathbed in little more than 24 hours.’ No autopsy was performed.

I don’t know what Gerry would look like angry,’ Andrew Wagner told the Netflix documentary.

Online, his social handicap didn’t matter.

Photos from his now shuttered Facebook page show him posed next to exotic animals, behind the wheel of a Lamborghini and straddling an ATV in a desert.

‘The first time I met Gerry was in Mike’s fancy car and Mike was doing all the talking and Gerry would laugh at his not-funny jokes,’ recalled Wagner in the Netflix doc.

Internet sleuths featured on ‘Trust No One’ discovered that Patryn’s real name was in fact, Omar Dhanani, a hustler with a criminal record that had previously been arrested in a sting operation for selling stolen credit card information in Southern California.

Sometimes the fraudster vanishes without a trace, but more often they hem and haw, blame circumstances outside their control , offer partial cash-outs, and equivocate until investors give up.

They installed a bitcoin ATM in its bare-bones Vancouver office , and accepted gold as payment that could be dropped off in person.

That same year, $2 billion was transacted through Quadriga and Cotten took a cut from every transaction.

‘Cotten was fulfilling the requests of whoever was screaming the loudest,’ said Daniel Tourangeau to Netflix.

In the meantime, Patryn had parted ways with Cotten in 2016 as part of a mass exodus that left the company over a disagreement to forgo an IPO.

He purchased a $600,000 sailboat, a brand new Cessna aircraft, and amassed a real estate portfolio that included four primary residences, .

He lived the high life with his soon to be wife, Jennifer Robertson that included exotic vacations around the world.

Quadriga customers were desperate to stanch losses and pull their money out of the exchange.

When she followed up the claims with Cotten, the conman explained that Quadriga was unable to process all the withdrawal requests because the Canadian Imperial Bank of Commerce had frozen $26 million.

What unwitting investors had not yet known, is that their money was already gone.

In the middle of this tumultuous year, Cotten and Robertson got married.

Trust No One follows a group of jilted Quadriga creditors who dig into the dubious death of Cotten and their missing millions.

Before the scandal, Cotten was considered to be a reputable authority on cryptocurrency.

QCXINT is in the camp that believes Cotten is still alive.

An official probe conducted by the Ontario Securities Commission was able to identify $46 million worth of assets, leaving an unexplained shortfall of $169 million.