Morgan Stanley, on the other hand, posted an earnings per share of $2.202 for the quarter, beating the consensus estimate of $1.68.

Following the stock market opening on Thursday, the S&P 500, and Nasdaq are trading lower at 0.17% and 0.62% respectively.

The International Energy Agency on Wednesday warned that from May onwards roughly 3 million barrels per day of Russian oil could be shut-in due to sanctions or buyers voluntarily shunning Russian cargoes.

The comments come after Finland and Sweden said their decision on whether to apply for NATO membership would come within a matter of weeks.

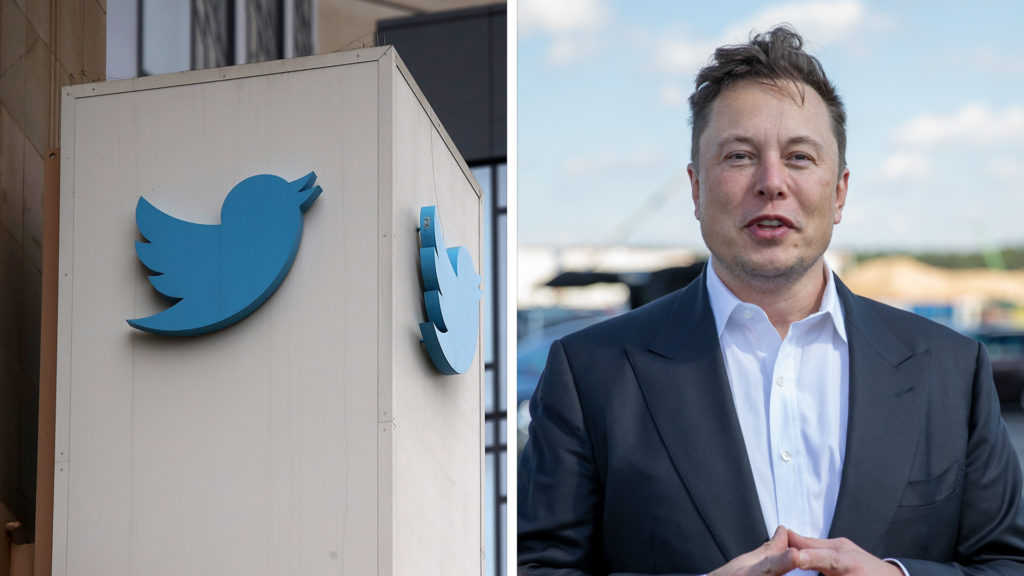

As a result of this flashy offer, TWTR stock is now gaining by over 5% at today’s opening bell.

Musk also explains, “I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.” Following that, he says, “However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form.

Not to mention, the offer of $54.20 per share does include the number 420 which Musk has a history with.

By and large, this is likely courtesy of the company posting its latest quarterly financial update today.

In the larger scheme of things, this is not all that surprising after considering TSM’s leading role in the industry.

Whether it is catering to a market with immense demand or making up for the shortfall in supplies, TSM stands to benefit.

Prices of penny stocks, cryptocurrencies and other financial instruments are extremely volatile and may be affected by external factors such as financial, promotion, regulatory and political events.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Stockmarket.com and/or the data provider.