Barring the realty basket, all sectors tracked by NSE were in the red in the morning, with IT, financial and oil & gas shares being the biggest drags on both headline indices.

Aniruddha Naha, Head-Equities at PGIM India Mutual Fund, is of the view that some correction was due in the IT space because of the price-to-earnings ratios that had expanded dramatically over the last two years.

“From an earnings visibility perspective, and from a valuation perspective, which have corrected vis-a-vis the top, this will be a sector where we would continue to add on in every correction.

Prakash Diwan, Market Expert said on HDFC and HDFC Bank merger that people wait to hear out the combined management of HDFC Ltd and the bank to figure out the plans to mitigate whatever concerns or issues.

Manish Sonthalia, Head-Equities PMS at Motilal Oswal, believes there is nothing wrong with the merger, though it could have come a bit earlier.

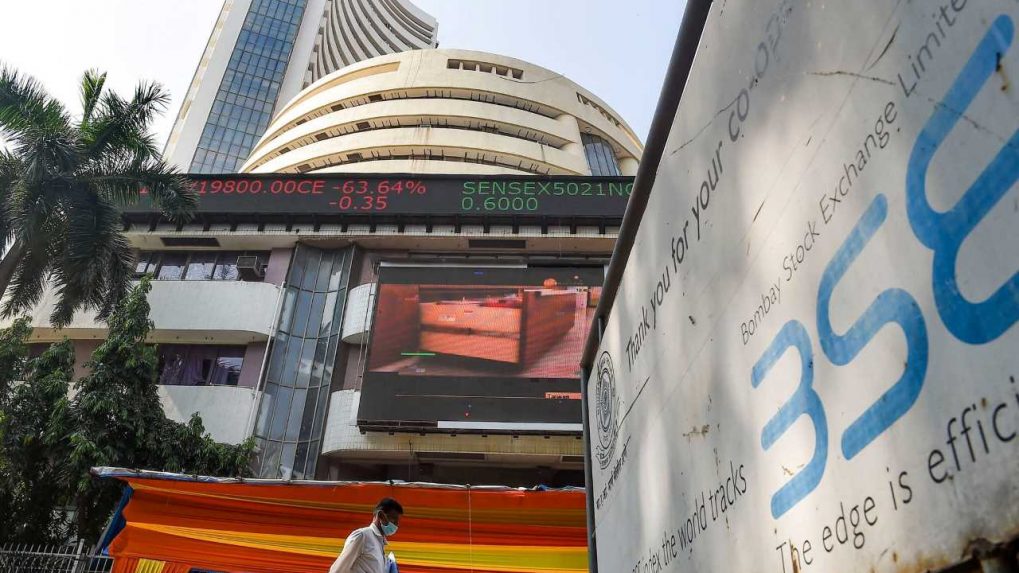

The 50-scrip index is down 113.4 points or 0.7 percent at 16,989.2 in some recovery from initial losses.

Mahindra & Mahindra posted total sales of 45,640 units in April, up 25 percent on a year-on-year basis.

Central bank action, the LIC initial share sale and corporate earnings will be in focus on Dalal Street in the holiday-shortened four trading session week starting May 2.