Broader markets slipped into the red in the second half of the session, with the Nifty Midcap 100 finishing the day one percent lower and the Nifty Smallcap 100 declining 0.3 percent.

Wipro, PowerGrid, Reliance Industries, Bharti Airtel and Larsen & Toubro also among the top losers.

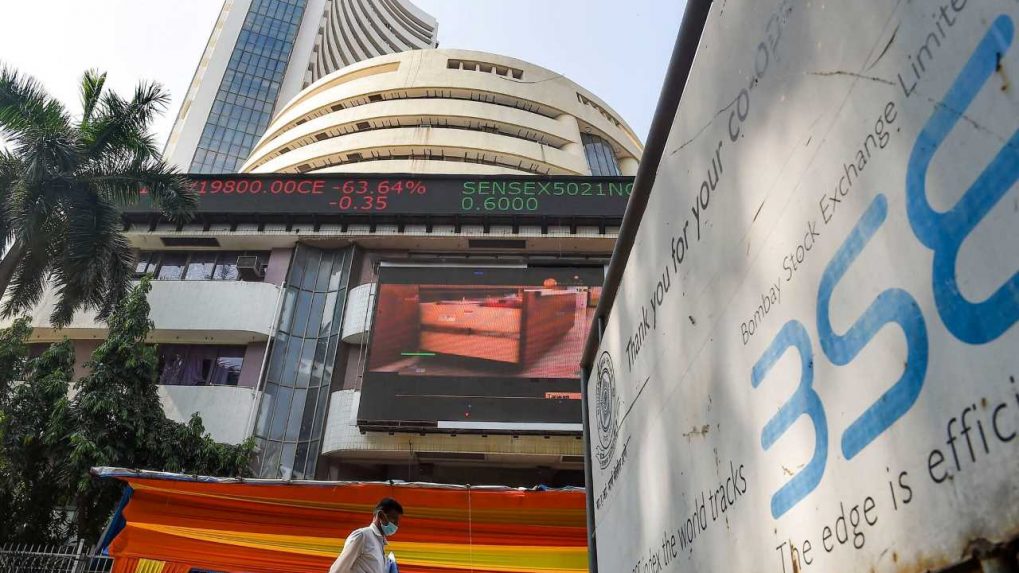

The Sensex finishes the day 575.5 points or one percent lower at 59,035 and the Nifty50 settles at 17,639.6, down 168.1 points or 0.9 percent from its previous close — both extending gains to the third day in a row.

In the last two years, a lot of the smaller logistic players have got completely wiped out in terms of the ability to maintain the fleet and to completely get the full load at the truck level, which means the margins have been hit for some of the smaller surface express providers…

“I am absolutely certain that some of these larger pan-India players will keep taking market share from some of the smaller guys, and the opportunity here is absolutely immense.

Ukraine’s urgent needs, the sustainability of supplies, and long-term solutions which will help Ukraine to prevail,” Kuleba wrote in a tweet which he said was sent from NATO headquarters in Brussels.

Deven Choksey of KRChoksey is of the view that there is nothing attractive in the midcap segment at the current juncture.

Unmesh Sharma, Head-Institutional Equities at HDFC Securities, likes the domestic economic recovery theme for the next 12 months.

He also likes the urban low ticket growth theme.

Pinakin Parekh, ED-Oil & Gas-Metal Research at JPMorgan India, tells CNBC-TV18 that in his view, steel companies will continue to generate better cash flows going forward.

Amit Sajeja, VP-Technical Commodities and Currencies Analyst-Commodities at Motilal Oswal Financial Services, recommends buying the April contract at Rs 7,550 for a target of Rs 8,050 with a stop loss at Rs 7,300.

Sunil Tirumalai, ED and India Strategist at UBS, is of the view that consensus EPS estimates for FY23 have actually held up quite well in spite of inflationary pressure.

“We are about 7-8 percent below consensus in terms of Nifty EPS.

Abhilash Narayan, Senior Investment Strategist-Group Wealth Management at Standard Chartered Singapore, tells CNBC-TV18 that US central bank members, in his view, seem to be becoming more concerned about inflation.

“Some of our short term challenges such as unprecedented global commodity inflation and the performance of our Indonesia business, continued to play out during the quarter, impacting consumption and margins.