Institutional investors have been driving the surge in demand for bitcoin and fueling the price increase for months.

More funds and financial institutions started investing their time, money, and reputation into crypto assets during the fourth quarter.

Despite all that institutional interest, CoinDesk said in a recent report that there are signs that retail investors started to take over the momentum in the cryptocurrency space during the first quarter.

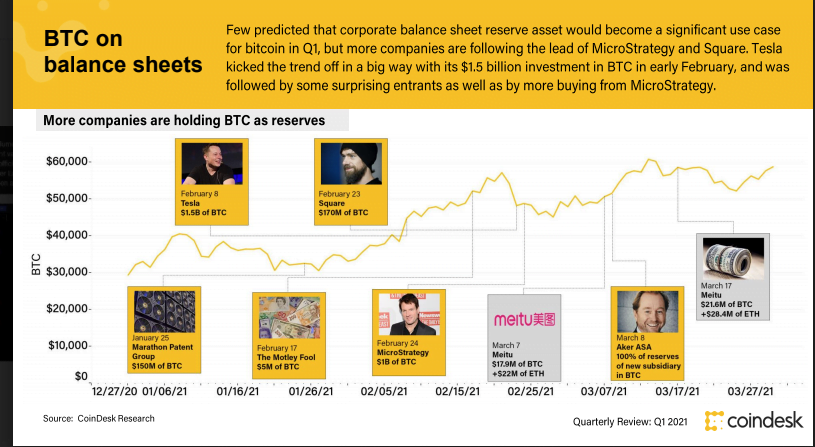

According to CoinDesk, not many predicted that significant corporations would start holding bitcoin on their balance sheets, but that trend has been picking up.

The Motley Fool bought $5 million in bitcoin in mid-February, while Square bought another $170 million worth of bitcoin, followed by MicroStrategy, which bought an additional $1 billion of the cryptocurrency.

In March, Meitu Inc bought $17.9 million worth of bitcoin and $22 million worth of ether, followed by Aker SAS, which holds 100% of the reserves for its new subsidiary in bitcoin.

Additionally, the over-the-counter price for the Grayscale Bitcoin Trust started trading at a discount to its net asset value; both of these factors are ratcheting up the pressure on the U.S.

Valkyrie filed for another ETF that would invest in companies with bitcoin on their balance sheets in March.

Bitcoin’s market capitalization surpassed $1 trillion during the first quarter, hitting $1.1 trillion at the end; this marks a significant milestone because, for many institutional investors, an asset is only worth considering when it reaches a minimum size.

However, the cryptocurrency broke that trend of weak performance in March with a 30% return, bringing its return to 100% for the first quarter.

Bitcoin started the year at a 12-month high, but its market dominance as measured by a percentage of total market cap continued to fall, diving below 60%; This makes a difference because it indicates that the crypto industry is becoming more diversified.

However, when considering bitcoin’s dominance among the top 20 crypto assets by trading volume, it becomes clear that its dominance has remained stable at 73% over the last 12 months.

Bitcoin spot trading volumes surged at top transparent exchanges starting in the third quarter, but that leveled off in the first quarter after hitting a record daily high of over $7 billion in January.

The surge in bitcoin future volumes during the fourth quarter slowed during the first quarter, although it still ended that quarter at nearly tripled the levels seen one year ago.

The CME also started the year off well, growing to become the biggest bitcoin futures exchange based on open interest, which signals the increased institutional activity.