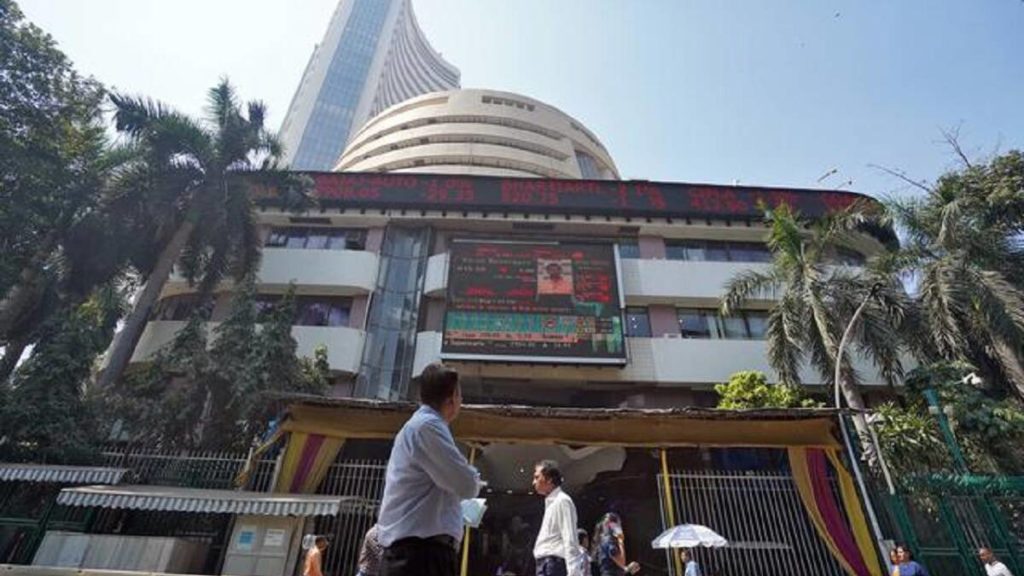

S&P BSE Sensex soared 200 points during the early hours of trade to regain 58,700 while NSE Nifty 50 was comfortably above 17,400.

Alternatively, slippage past 17324 may not lead to collapse, but a comfortable re-entry for longs would be near 17195 in such case,” said Geojit Financial Services.

In the grey market too, shares of Anand Rathi Wealth were seeing strong interest from investors and trading at a healthy premium of Rs 125 per share to the IPO price of Rs 530-550 per share.

India’s PMI data for November indicated that the Indian service sector continued to strengthen, with a substantial upturn in new orders underpinning output growth.

If the market turns from here and breaks 17100, we would revisit the recent lows,” said Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments.

Stocks fell on Friday after Chinese ride-hailing giant Didi said it would delist in New York, renewing concern about U.S.-China tensions and tech regulation, while oil headed for a sixth consecutive weekly drop on Omicron and rate hike worries.

Going forward, investors have to be a little cautious as the two cases of Omicron variant has been detected in India and can cap the upside movement of the market.

Gopinath, who was scheduled to return to her academic position at Harvard University in January 2022, has served as the IMF’s chief economist for three years.

Traders can consider buy in dips with strict stop loss for 17600 as targets in the next few sessions,” said Gaurav Udani, Founder and CEO of ThincRedBlu Securities.

“We may see some pullback since Dow Futures are trading negative this morning but this remains a buy on dip setup for next target of 17800.

“Nifty nicely build on the gains made on the previous day on Dec 02 and crossed the crucial 17355 level.

“A decisive upside breakout of the hurdle of 17400-17600 levels could only change the short term negative sentiment of the market,” said Nagaraj Shetti, Technical Research Analyst, HDFC Securities.

Now it needs to continue to hold above 17350 zones for an up move towards 17500 and 17777 zones whereas support can be seen at 17150 and 17000 zones.

The company profitability was severely impacted in FY21 due to higher claims arising due to Covid-19 pandemic.

If the market has to resume the current weakness, it would need to take a U-turn from here and head downward.