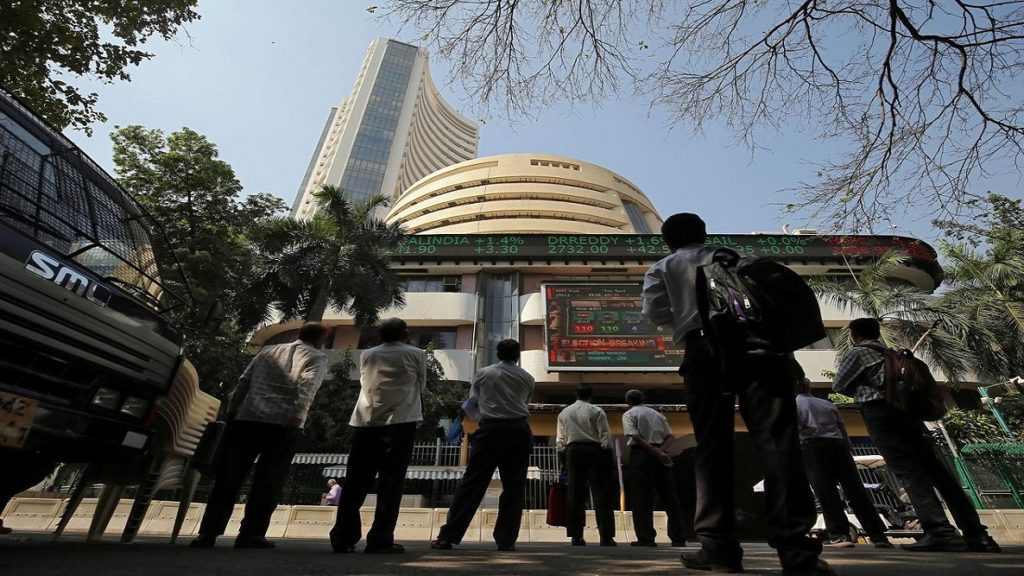

S&P BSE Sensex added 611 points or 1.09% to close at 56,930 points while NSE Nifty 50 index rose 184 points or 16,955.

Domestic markets continued to move higher on Wednesday, extending their gaining streak to the second day straight.

iPhone maker Foxconn Technology’s India unit has filed draft IPO paper for a Rs 5,000 crore e public issue.

The research and brokerage firm believes that Nykaa’s superior consumer engagement metrics in BPC/Fashion and over 13 million social media followers position Nykaa as the partner of choice for these brands’ advertising needs.

We believe 17000 would act as immediate hurdle as it is a confluence of the Monday’s gap area of is placed at 17025,” said ICICI Direct.

Further, the investments in content creation would increase as there is increased concentration on both the platforms and with the infusion of additonal capital in excess of $1bn, they could compete aggressively with Amazon & Netflix.

Morgan Stanley analysts have initiated coverage of Paytm parent company One97 Communications with an ‘Overweight’ rating, and a target price of Rs 1,875 per share.

SBI, IndusInd Bank, ICICI Bank, and Kotak Mahindra Bank were up with gains.

Yesterday when it appeared as if we are going to challenge the 17000 mark, this gap area proved its significance as we witnessed a sudden decline after nearing the higher end of the gap.

The billionaire investor, who is often dubbed as Rakesh Jhunjhunwala’s mentor, is the promoter of Avenue Supermarts, a hypermarket giant, and is known for being a value investor.

Short covering was seen in the Nifty & Bank Nifty futures, Short covering by FII’s in the Index Futures and Put writing at 16700 levels Indicates that one should be optimistic for the markets.

The index has opened in the green but we are still not out of the bearish quarters.

The total size of the Metro Brands IPO was Rs 1,368 crore, of which Rs 1,073 crore was an offer for sale and Rs 295 crore was a fresh issue.

On the Multi Commodity Exchange, gold February futures were ruling Rs 141 or 0.3 per cent down at Rs 48,099 per 10 gram, as against the previous close of Rs 48,240.

Nifty Futures and Bank Nifty futures both witnessed short covering however, volumes were lower by 20% on a bounce-back day,” said Rahul Sharma, Director & Head – Research, JM Financial.

The benchmark indices witnessed a sharp pullback rally as the Nifty 50 ended 156 points higher while the BSE Sensex was up by 497 points.

The underlying trend remaining down as the index formed lower lows along with fall in index PCR OI, indicating trader sentiment is bearish and fresh call writing was seen at strike price 17000 with 7 lakh shares , Combined with a fall in the option price and IV, it indicates that call writing has happened at these strikes implying immediate resistance at these levels for the near term.

Nifty structure still remains ‘sell on rise’ with multiple resistances seen from 17,000 to 17,200.

“While the market trend might be volatile in the near term on account of potential risk from Omicron variant and fragile global cues, we suggest long term investors to take benefit of such volatility in the market and add on to their portfolios gradually at lower levels,” Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services Ltd, said.

There is a possibility of minor upside bounce towards 17000-17100 levels in the next few sessions and the market is expected to reverse down from the higher levels.