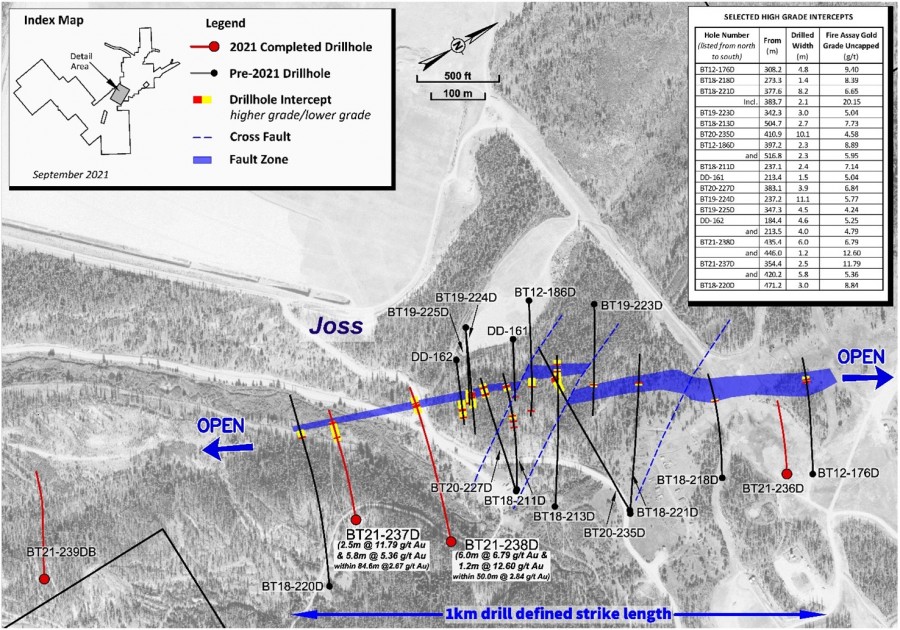

Drilling at the high-grade Joss target at Beartrack-Arnett returned intersections of 6.79 g/t gold over 6.0 meters and 12.6 g/t gold over 1.2 meters within 2.84 g/t gold over 50.0 meters in hole BT21-238D.

These results are entirely beyond the existing mineral resource at Beartrack-Arnett and provide further evidence of the high grade and continuity of mineralization at Joss”, said Hugh Agro, Revival Gold, President & CEO.

Results from BT21-238D are similar to those reported for drill hole BT21-237D, located approximately 180 meters to the south along the Panther Creek Shear Zone .

The 2021 drilling program at Haidee consists of 2,500 meters of engineering and exploration core drilling to augment and expand on the current Haidee Mineral Resource for the first phase restart of gold production from Beartrack-Arnett.

Steven T.

Meanwhile, exploration continues, focused on expanding the current Indicated Mineral Resource of 36.6 million tonnes at 1.15 g/t gold containing 1.36 million ounces of gold and Inferred Mineral Resource of 47.1 million tonnes at 1.08 g/t gold containing 1.64 million ounces of gold.

Revival Gold has approximately 71.2 million shares outstanding and had an estimated cash balance of C$6 million on June 30th, 2021.

Priesmeyer, C.P.G., Vice President Exploration, Revival Gold Inc., a Qualified Person within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, the Company’s ability to predict or counteract the potential impact of COVID-19 coronavirus on factors relevant to the Company’s business, failure to identify additional mineral resources, failure to convert estimated mineral resources to reserves with more advanced studies, the inability to eventually complete a feasibility study which could support a production decision, the preliminary nature of metallurgical test results may not be representative of the deposit as a whole, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR.