Once the emergency funding of businesses and jobs abates as the COVID-19 crisis ebbs, it may be increased significantly.

Large economies such as France, Japan, South Korea, Sweden, New Zealand, Denmark and Sweden have enacted similar legislation.

But the game changer is China, the world’s biggest burner of coal and the largest market for all fossil fuels.

Tal Lomnitzer, senior fund manager at Janus Henderson, says: “When China committed to net zero, I don’t think it registered as the seismic event it is.

What is good for the planet can also be positive for investors, particularly those with ESG concerns who are cutting coal, oil and other fossil fuels from portfolios.

Regardless of whether an investment view embraces rising inflation and a commodities supercycle, there is a secular, fundamental case for owning these metals.

King copper Copper earned the soubriquet ‘king’ because it is widely regarded as a bellwether of global economic activity.

Having traded as low as $4,600 per tonne in March it is currently priced at over $8,000/tonne.

Christian Kjaer, head of liquid markets and multi-asset investment at ATP, Denmark’s supplementary pension scheme with DK960bn in assets and the fourth-biggest pension fund in Europe, says: “In 2020, copper prices were supported by China recovering rapidly from Covid.

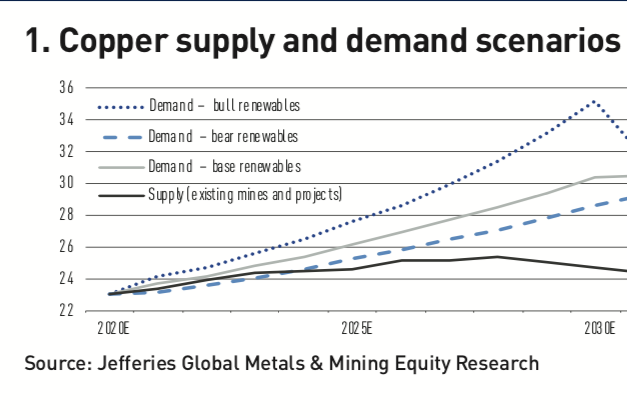

In all three scenarios set out in its report – base case, bull and bear – “the copper market is entering an extended period of deficits”, Jefferies analysts write .

It means mined supply will not keep pace with demand and other more expensive sources, such as recycling, will need to be tapped.

“There is a laundry list of copper projects in the pipeline but many are located in places that are difficult to operate in for a range of environmental and geopolitical reasons.

Every tonne of mined copper is a tonne less in the ground unless new sources are found, and depreciation has exceeded capital spending in the mining sector for a decade.

It is already used industrially for the catalytic converters that all modern cars are fitted with.

Having peaked at a price of over $2,000 per troy ounce in 2008, platinum now trades at $1,174/troy ounce.

That can largely be explained by an emerging technology, proton exchange membrane fuel cells which electrochemically react hydrogen with oxygen to produce electricity.

Asked whether to accept the case for platinum it is also necessary to see hydrogen as an important part of the future energy mix, Bank of America Merrill Lynch’s Widmer is succinct: “Yes and yes and we do.” That will require a lot of investment, but governments are stepping up.

Daimler and Volvo have a joint venture working on FCEV trucks and Airbus plans to have a zero-emissions hydrogen-powered aircraft in the skies by 2035.

“Before you get to the point of internal combustion engines being scrapped, boosting the supply of recycled platinum, you will have ever more demand for catalytic converters, as emissions rules tighten and hydrogen fuel cells.

Almost 90% of Rio Tinto’s Scope 3 carbon emissions, indirect emissions that result from a company’s supply chain, can be attributed to iron ore being processed in coke-powered furnaces.

Nickel and dimesBefore FCEVs running off hydrogen become a core part of transportation, most EVs will be running off nickel-cobalt-manganese and nickel-cobalt-aluminium batteries.

These cars currently do not have the range of nickel batteries but meet the needs of most commuters.

Second, there is one nickel price, but only high-grade nickel can be used in batteries to power EVs.

Buying any of those mining superpowers gives exposure to a lot more than class 1 nickel, including many other metals and the skill, or otherwise, of the management teams. But the biggest drag on class 1 nickel prices might be an emerging technology that processes low-grade nickel pig iron into an intermediate product called nickel matte.

There are other less-liquid metals that should benefit from decarbonisation including lithium, cobalt and even uranium.

Janus Henderson’s Lonmitzer says he shies away from using the term ‘super cycle’ when talking to potential investors about the metals and mining sector.

COVID-19 infection rates are still rising in the US and Japan, hopefully on the verge of decreasing in the EU and low in the UK.

Copyright © 1997–2020 IPE International Publishers Limited, Registered in England, Reg No.