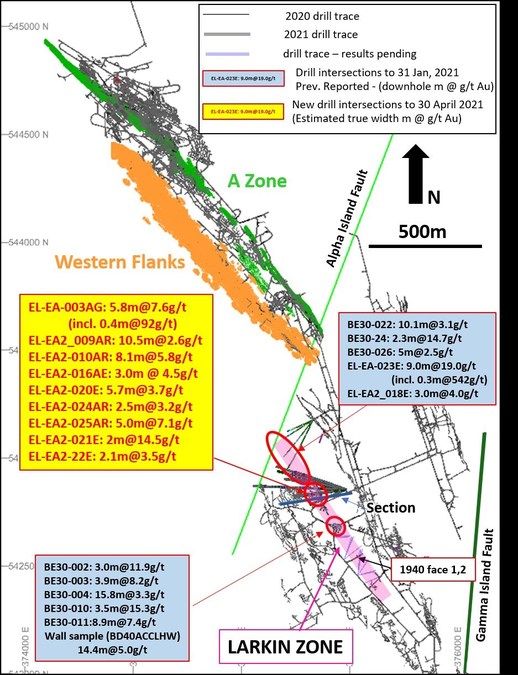

Paul Huet, Chairman and CEO of Karora said, “Today’s results demonstrate the continued growth of the Larkin Gold discovery which now extends over an interpreted strike length of 650 metres and up to 120 metres down dip, while continuing to remain open along strike and at depth.

An intercept of 4.2g/t over 12.2 metres including 7.6 g/t over 5.8 metres in drill core EL-EA2-003AG as well as a face sample of 6.1 g/t over 4.6 metres build upon the strong results previously reported in February.

I am very pleased with how far we have advanced the work to achieve a maiden Mineral Resource estimate for the Larkin Zone.

For our maiden resource calculation, we intend to complete drill testing of Larkin over a strike length of 1,000 metres and up to 150 metres below the ultramafic / basalt contact during the third quarter.

Turn-around times on assay results continue to be held-up by industry-wide laboratory capacity issues resulting from increased demand for their services and labour supply hurdles related to COVID 19 restrictions.

Also, since previously reporting on the Larkin Zone, two level development cuts were taken as an exploratory drive initiated from the existing 1940 development along the interpreted west-dipping main zone to assist in interpreting Larkin Zone mineralization.

Where problems have been identified in QAQC checks, Karora personnel and the SGS and ALS laboratory staff have actively pursued and corrected the issues as standard procedure.

At Beta Hunt, a robust gold Mineral Resource and Reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions.

Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities ; general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

This decision by Karora to continue production and, to the knowledge of Karora, the prior production decision were not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit.