Companies’ growing acceptance of bitcoin for payment could bring wider adoption, and the consequent increase in demand could dampen volatility.

The major challenge is volatility, which ensures that it is neither a good store of value nor a unit of account.

Regulatory uncertainties and crypto influencers’ changes of attitude can feed this volatility.

Bitcoin is treated as a property rather than a currency, which implies that users need to pay capital gains taxes or recognize tax losses when transacting.

These limitations prevent the network from handling large numbers of transactions, which can result in delays in processing times and increasing transaction fees, making it inefficient and expensive.

With these companies’ participation making access easier, bitcoin could draw more usage from the public.

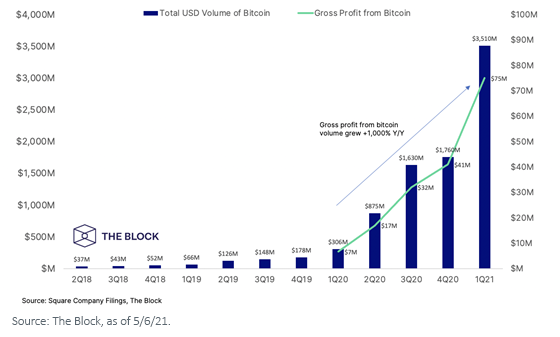

The success of Cash App indicates the service’s high demand.

In November 2020, PayPal established its crypto selling and buying services.

The lightning network was introduced in 2017 and has been adopted by major crypto exchanges such as Kraken and OKEx.

1 Sources: Kyle Croman et al, “On Scaling Decentralized Blockchains ,” International Conference on Financial Cryptography and Data Security, 2/16; “Visa Fact Sheet,” usa.visa.com, 7/19.

Information provided by WisdomTree regarding digital assets, crypto assets or blockchain networks should not be considered or relied upon as investment or other advice, as a recommendation from WisdomTree, including regarding the use or suitability of any particular digital asset, crypto asset, blockchain network or any particular strategy.

Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility.

This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such.