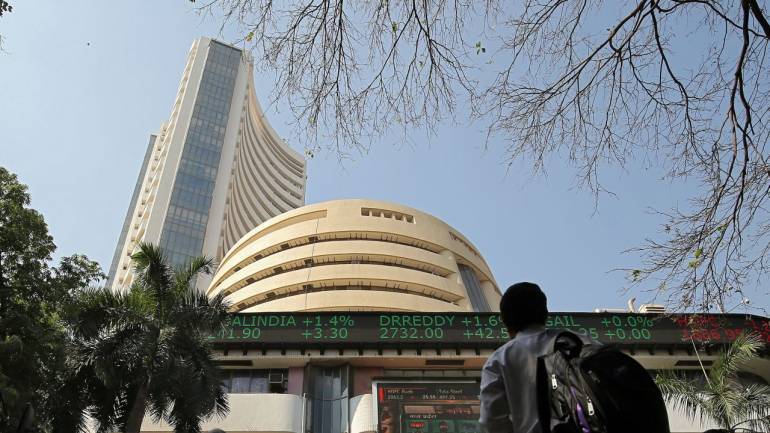

Index closed a day at 14819 with gains of nearly one percent and formed a bullish candle on the daily chart.

RBI’s decision to maintain its high GDP growth forecast also helped the market to calm down its fears which had increased post the second wave infection and stringent lockdowns.

On a day when several states go into polling, the dovish stance of RBI cheered the street as rate sensitives looked up even as several midcap names across sectors saw keen investor interest.

As of now, the short-term technical condition of the market shows an upward shift of the prevailing market range and it is likely to range between 14600 and 15100.

The Indian rupee has went on to witness steep depreciation towards five-month lows as rising Covid-19 cases in the country have created an atmosphere of lingering uncertainty, posing risks to an already fragile state of recovery.

Facing hurdle at 72.20 mark, the domestic currency has reversed course in a rather steep manner and looks poised to witness further depreciation in coming days, even as sustained portfolio inflows are still underpinning the local unit.

Gaurav Dua, SVP, Head – Capital Market Strategy, Sharekhan by BNP Paribas In line with expectations, RBI has maintained status quo on policy rates and reassured the financial markets on its commitment to retain accommodative policy stance till the prospects of sustained economic recovery is secured.

In this regard, RBI has announced GSAP of Rs 1 lakh crore in 1QFY22, of which Rs 25,000 crore would be conducted on 15th April’21.