It’s unclear when the market will begin operating, a spokesperson with the Shanghai Environment and Energy Exchange, which will host trading, said Monday.

Trading won’t now happen until after July 1 because of a lack of organization, according to a person familiar with its development.

The Ministry of Ecology and Environment, which oversees the carbon market, didn’t respond to a faxed request for comment.

There are also concerns it could be years before the system delivers meaningful impact, with generous carbon emissions allocations unlikely to spur quick action to curb pollution.

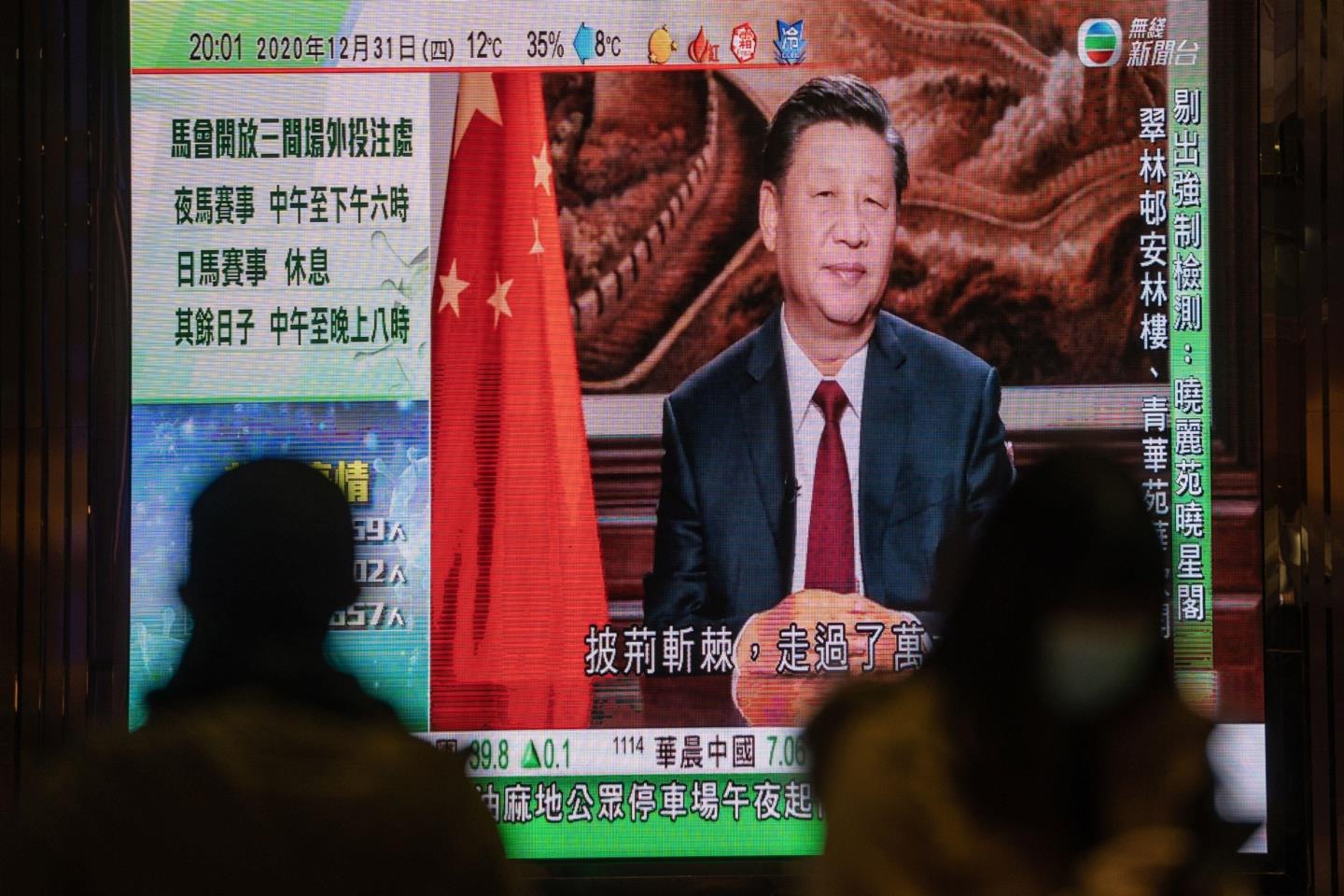

The market is intended to be another tool President Xi Jinping can use to help meet China’s goal of hitting peak emissions by 2030 and carbon neutrality by 2060.

China’s system is intended to force companies to pay for at least some permits to release carbon dioxide, encouraging them to use fuel more efficiently and reduce pollution.

Last week, the Shanghai exchange said listed transactions will be for 100,000 tons of carbon dioxide equivalent or less, and price moves will be within 10% of the prior day’s close.

The system will initially cover more than 2,200 companies in China’s power sector, which account for about half of the emissions in the world’s biggest polluter.