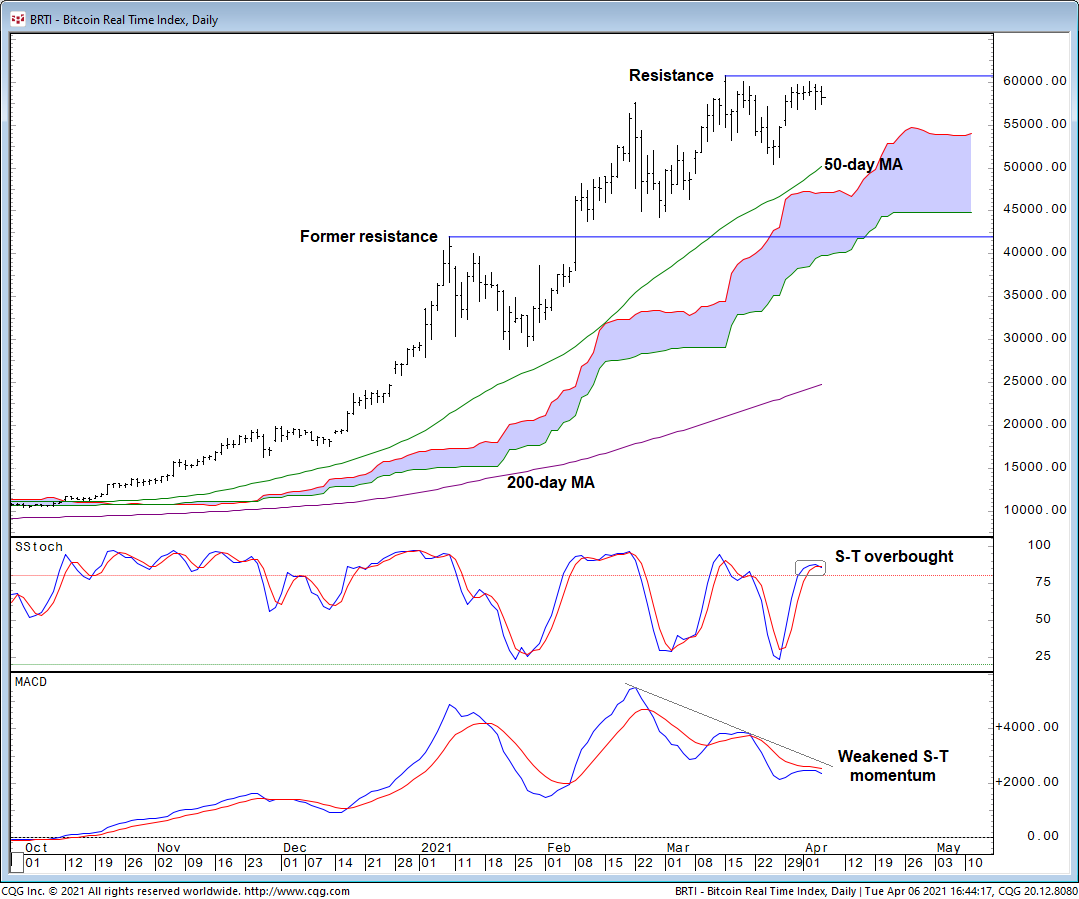

Bitcoin’s month-long consolidation between $50,000 and $60,000 reflects a tug of war between buyers and sellers.

EOS has outperformed BTC over the past five days, while ether has shifted from the improving quadrant to the leading quadrant over the same time period.

Bitcoin update BTC has been moving downwards since getting rejected by the $59,500 resistance area on April 6.

Scaramucci appeared to share this belief too, as he went on to state, “The technology around Ethereum is going to make it a sticky cryptocurrency and a store of value and something people will transact with.” What Else: While he wouldn’t recommend a 20% portfolio allocation towards cryptocurrency just yet, Scaramucci thinks that an allocation between one and three percent would be ideal for investors.

In his latest annual letter to shareholders, JPMorgan Chase CEO Jamie Dimon offered thoughts on how the US economy will boom after the pandemic thanks to excess savings, huge deficit spending, a new potential infrastructure bill, and the success of Covid-19 vaccinations.

Federal Reserve is expected to release the minutes from its most recent monetary policy meeting later on Wednesday, which will be parsed for any changes in its economic outlook and clues as to when it expects to tighten its accommodative stance.

The S&P 500 and the Dow reached record levels with the CBOE volatility index retreating to pre-pandemic lows, driven by fiscal stimulus packages and swift COVID-19 vaccinations in the United States that led to blowout employment as well as service sector reports for March.

In India, state-run refiners are looking to buy less crude from Saudi Arabia as demand in the Asian nation is poised to dip amid a resurgence of Covid-19, and relations between the two countries sour over prices.“With supply-side support dwindled, marginal price action in oil markets will now shift to demand dynamics, without as much of a safety blanket from the supply side,” TD Securities commodity strategists led by Bart Melek said in a note.