I suppose, like most people, the most important financial decisions that I make are with respect to retirement savings.

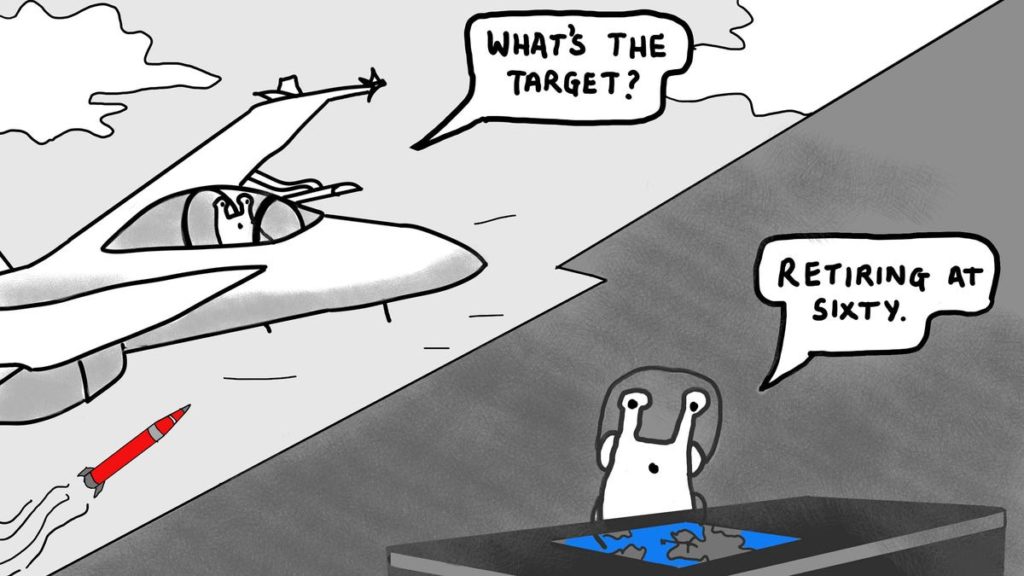

I like to think of myself as the pilot of my financial affairs while he is my navigator…

The UK regulator favours a more cautious approach, at least for the foreseeable future.

Once the digital asset market is properly regulated, and funds are able to make well-informed choices about tokens that are backed by assets of varying classes then they may well decide to store tokens of various kinds in addition to traditional holdings.

Personally, I do wonder if it is perhaps too soon to be looking into the direction of cryptoassets when considering prudent retirement strategies although I do note that some investment professionals take a different view.

Maybe people will switch some of their savings from assets that they intend to sell in the future in order to obtain money so that they can buy electricity or water or food into tokenised versions of the electricity or the water or the food itself.

The plan works like this: Savers, typically wage-earners such as teachers, pay in cash which the company turns into cattle.

Jonathan isn’t a rose-tinted future-addled techno-hype merchant like me, but a serious and experienced financial services power player.

A couple of years ago, Banque de France first deputy governor Denis Beau gave a speech, in which he reflected on the inefficiencies in the sector and said that tokenisation could be a way to “answer the market’s demands”.