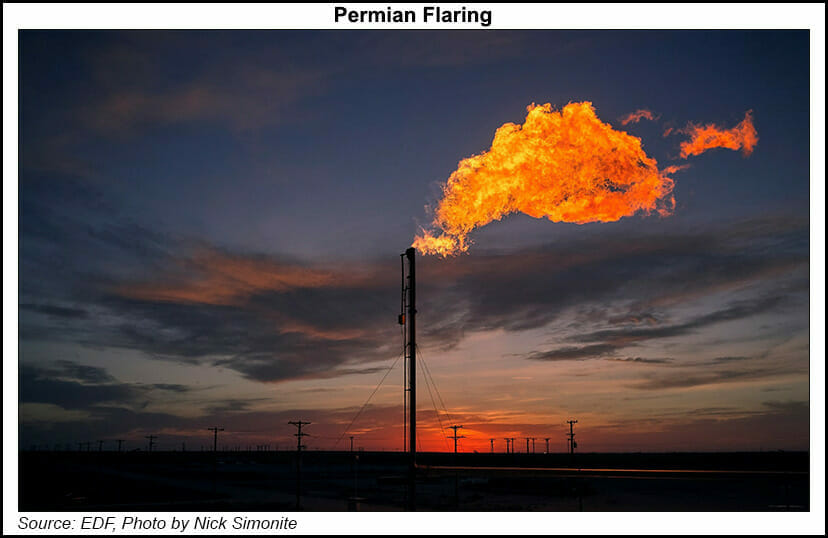

Both groups are seeking to capitalize on immense volumes of excess and/or stranded natural gas flared off or shut in by a lack of infrastructure.

“Our goal is to monetize the gas as well as solve some of the environmental problems of leaking wells and flared gas,” said EZ Blockchain CEO Sergii Gerasymovych.

“Mining” in this context refers to the energy-intensive, round-the-clock process through which specialized computers verify bitcoin transactions.

A new block is added to the chain about every 10 minutes on average, and the reward is how new units of the digital currency enter into circulation.

Bitcoin mining consumes an estimated 8.64 GW of power globally, or 75.62 TWh on an annualized basis, according to the latest modeling by University of Cambridge Bitcoin Electricity Consumption Index.

The arrangement provides miners with a cheap, abundant source of energy, while exploration and production firms are able to monetize gas volumes that otherwise would not have a market.

Giga Energy uses excess gas from conventional oil wells in East Texas to power its onsite bitcoin mining operations.

“Both of those solutions were interesting, but we could only scale the onsite power generation to a point where we could use the power,” Larsen said.

Gerasymovych and his team started analyzing flaring data in North Dakota and started asking producers in the state if EZ Blockchain could purchase their excess gas to mine bitcoin.

EZ Blockchain proposed a model in which producers would pay the entire upfront cost of the data center, supply it with gas and power, and pay the company a flat fee to operate it.

NGI’s Nathan Harrison, senior systems engineer, said large companies in historically conservative industries such as insurance are beginning to embrace Bitcoin as a hedge against inflation and a store of value.

Oilsands production in Canada is expected to grow despite the cancellation of the 830,000 b/d Keystone XL pipeline project because other export pipelines continue to advance toward completion, according to IHS Markit.