“With our mining operations at Helios expected to commence in May, along with the development of custom mining machines using Intel’s next-generation Blockscale ASIC chips, Argo is well-positioned to continue its growth with a focus on delivering for our shareholders,” said CEO Peter Wall in a statement.

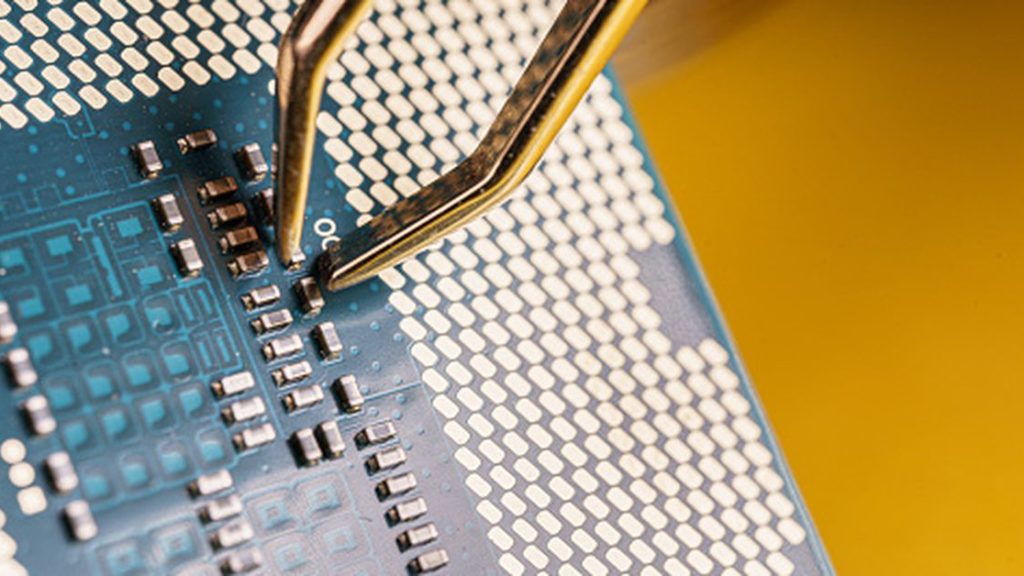

On April 4, Chip giant Intel launched its second-generation bitcoin mining chip, called “Intel Blockscale ASIC,” which will offer miners more efficient mining rigs than most models available in the market.

“It gives the bitcoin mining space more credibility to have a blue-chip company like Intel coming in, but it also will benefit the industry to have a more diverse supply chain and more options for ASICs and also to have chips available as opposed to fully-baked machines,” he said.

The additional capital spending to complete this first phase is expected to be in the range of $125 million to $135 million, which will be funded mainly through debt and proceeds from selling a portion of mined bitcoins each month.

The majority of the capital allocated for the first phase’s infrastructure build and Bitmain machines has already been paid.

Shares of the miner surged about 15% in London on Thursday before falling back.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period.