Nineteen of the biggest banks were subjected to the annual Dodd-Frank Act Stress Tests and the Comprehensive Capital Analysis and Review examinations, plus four smaller firms that chose to opt in: BMO Financial Corp., MUFG Americas Holdings, RBC U.S.

Under rules the Fed finalized in 2019, banks with assets of between $100 billion and $250 billion are only required to undergo stress tests every other year.

The Fed found that under that scenario, all of the banks subjected to the stress tests would collectively suffer $470 billion in losses, with almost $160 billion losses from commercial real estate and corporate loan investments.

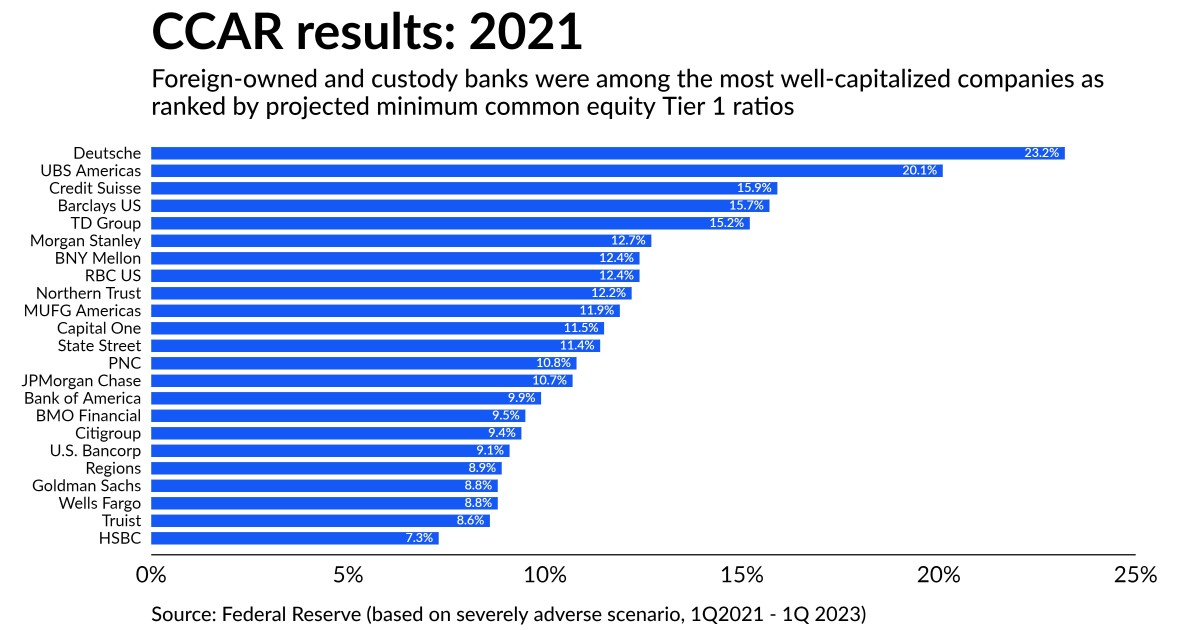

The central bank also noted that the stressed capital ratios varied widely across the 23 banks tested, which reflects the differences in the composition of each firm’s loan portfolios.

The results of the CCAR stress test are used to dictate a firm’s planned capital distributions for the year.

The Fed did not publish the stress capital buffer requirements Thursday, to allow for banks to make changes to their original capital distribution plans.

Also on Thursday, the Fed said it had corrected an error in both of last year’s stress tests that affected the results for BNP Paribas USA, and altered the bank’s pre-provision net revenue, projected pretax net income and projected capital ratios accordingly.