The headlines about inflation have, once again, been awful.

Stocks and bonds have been shaky since the start of the year, and the tragedies of the larger world are profound and proliferating.

Yet precisely because so much awful news has already been incorporated in stock, bond and commodity prices, there is reason for suspecting that market conditions may not get much worse and may even get better before long.

“Been Down So Long It Looks Like Up to Me”: That’s the title of a 1966 counterculture novel by Richard Fariña, a songwriter and folk singer, about his student years at Cornell.

How is it possible to survive spring in Ithaca, N.Y., when the cold, gray weather just keeps coming? The answer: Embrace misery.

Further declines will surely come, but it will take new, unexpected shocks to unmoor stocks, bonds and commodities in a fundamental way.

Yet even so, better times will arrive eventually — if not this month, then soon enough, for those willing and able to hang in until the season changes.

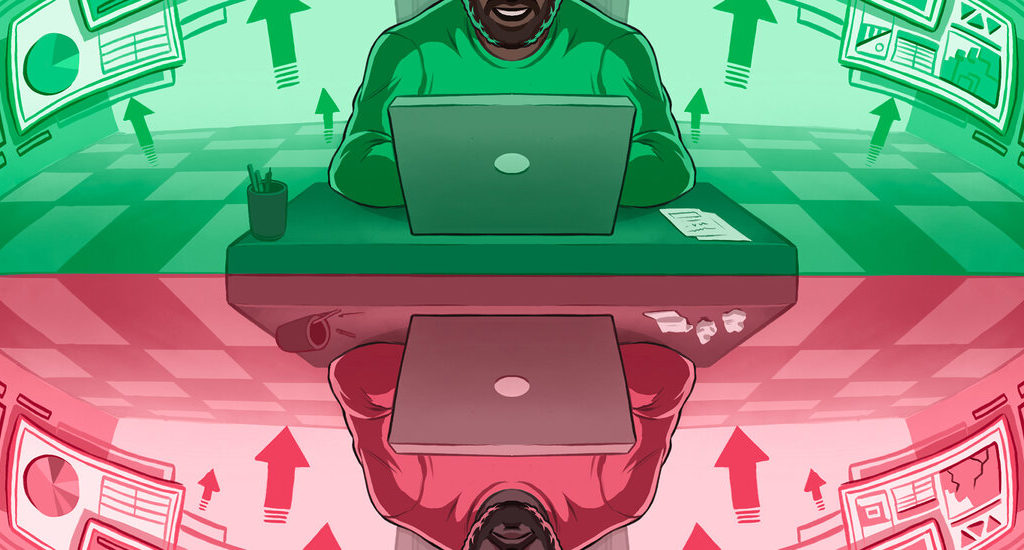

Finding encouragement in the middle of misery isn’t popular.

Just as too much optimism can induce you to make foolish bets, excessive gloom can lead to panic — which, in this case, could mean fleeing investments in both stocks and bonds, because both major asset classes have performed poorly.

But after that, if you invest steadily in diversified, low-cost index funds that track the entire stock and bond market, those low prices can be a boon, assuming the markets eventually recover.

The most recent government report on the Consumer Price Index showed that overall inflation in the United States rose at an 8.5 percent annual rate in March, the highest pace since December 1981.

John Butters, senior research analyst for FactSet, a research company, wrote in a report on April 12 that 65 percent of S&P 500 companies that have reported earnings for the first quarter of this year cited inflation as their biggest problem.

Europe gets nearly 40 percent of its natural gas from Russia, and it is likely to be walloped with higher heating bills.

Russia is the world’s largest supplier of wheat; together, it and Ukraine account for nearly a quarter of total global exports.

The price of palladium, used in automotive exhaust systems and mobile phones, has been soaring amid fears that Russia, the world’s largest exporter of the metal, could be cut off from global markets.

Because inflation began to surge 12 months ago, the year-over-year comparisons will be more favorable this spring.

That’s all changing now.” As the labor bottleneck eases — thanks, in part, to higher wages — he said that the supply of goods and services will begin to meet the demand for them, reducing pressure on prices.

Andrew Slimmon, a managing director at Morgan Stanley Investment Management, said in an interview that freight costs and shipping backlogs have been dropping, which may predict that the C.P.I.

On Thursday, the Conference Board, a business research organization, projected an extremely wide range of possible outcomes for oil prices, inflation, economic growth and interest rates.

The critical question for short-term traders is whether financial markets have already baked in sufficient pessimism.

With a little luck, those with the fortitude to have hung on when the outlook looked grim will find they have prospered.