It appears that global investors have entered the year with a reduced appetite for risk, and so the correlations between speculative assets such as cryptocurrencies and equities have increased, which results in widespread losses.

Alternative cryptocurrencies led the way lower on Friday given their higher risk profile relative to bitcoin.

In the short term, we can bounce to challenge the $45K-$50K zone, but the overall outlook remains bearish as liquidity remains tight,” Pankaj Balani, CEO of Delta Exchange, a crypto derivatives trading platform, wrote in an email to CoinDesk.

“Many altcoins are into support at their summertime 2021 lows, making it critical that bitcoin holds support as it sets the tone for the cryptocurrency space,” Katie Stockton, managing director of Fairlead Strategies, a technical research firm, wrote in a Friday briefing.

Bitcoin led the liquidation pack at $250 million, followed by ether at $163 million and SOL at $10.9 million.

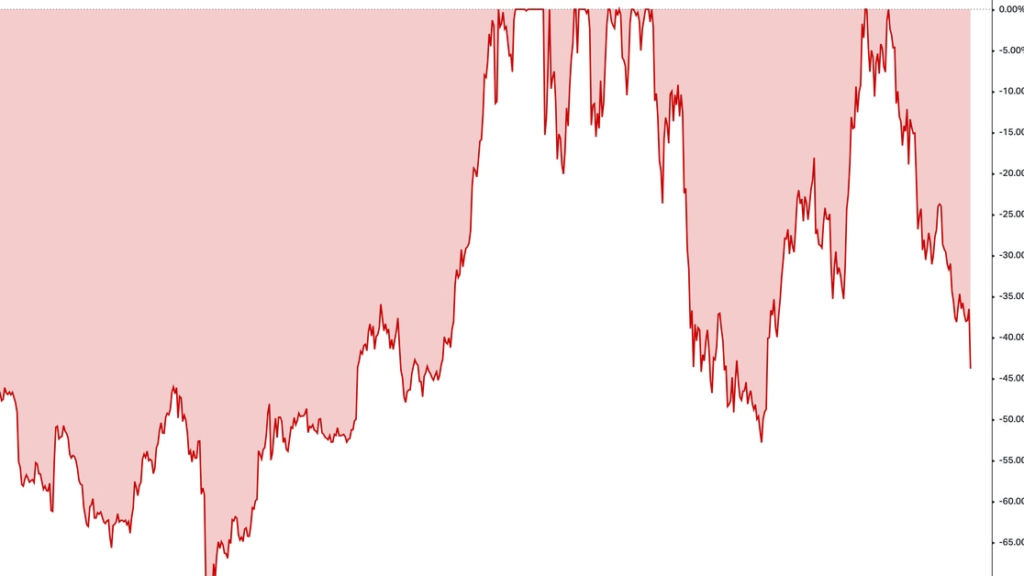

The previous drawdown extreme was in July when BTC settled near $28,000 after falling roughly 50% from its peak.

Sector classifications are provided via the Digital Asset Classification Standard , developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies.

Damanick is a crypto market analyst at CoinDesk where he writes the daily Market Wrap and provides technical analysis.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period.