“My feeling is, and my model is saying, the progress in bringing unemployment down is going to be slower than what we thought six months ago,” he said, adding unemployment in the U.S.

While GDP is close to pre-pandemic levels, the labor market won’t fully recover until the end of 2023, Witte said.

Spending on goods is about 18% above levels seen in February 2020, while spending on services is about 3% below pre-pandemic levels.

That should change as restaurants and events begin to reopen.

That’s where supply chain issues could be a good thing, he added.

Witte said supply chain issues largely stem from isolated incidents, such as a semiconductor factory fire in Taiwan, winter storms in Texas, and more recently the hacking of the Colonial Pipeline.

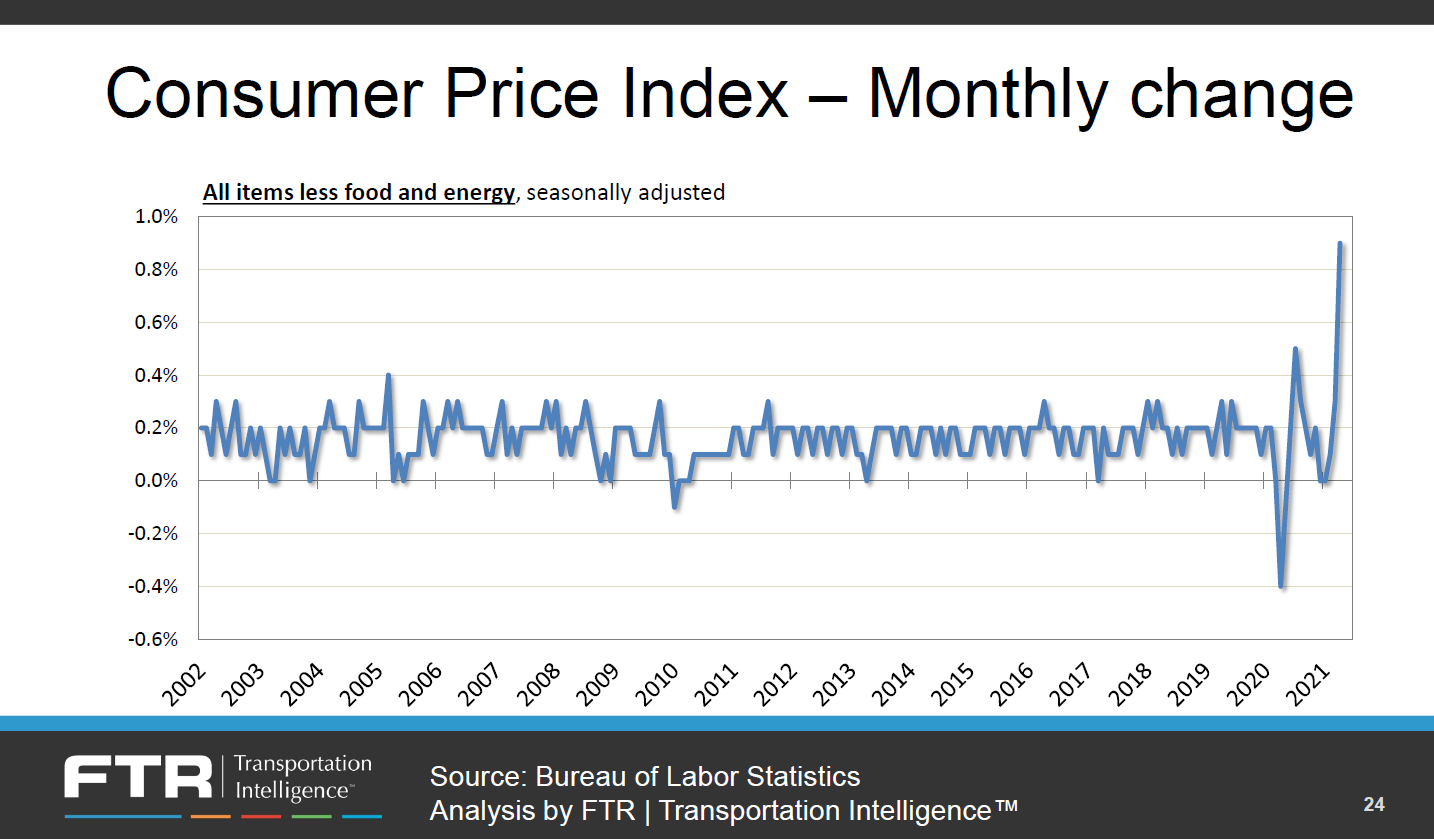

While a rising Consumer Price Index is being downplayed by some, Witte said inflation risks shouldn’t be ignored.

“The danger with inflation is when it starts to become a built-in kind of thing,” he said.